As we approach HBI 2023 later this month, we spoke with Rahma Samow, EVP, Global Head of Dental Services at the Straumann Group and a panelist at the dentistry session entitled What is your elixir of growth? A Dentistry case study. Gain insights into her role and the global impact of oral health trends on enterprise DSOs.

Samow, also executive board member and executive vice president, has a wide remit. She tells HBI: “I take the entire Straumann Group portfolio brands and services across all product segments, be it implants, bone regeneration, digital, orthodontics and preventive solutions and position this to DSOs (Dental Service Organisations) and GPOs (Group Purchasing Organisations). It’s about consultative solution selling, co-creation, portfolio expansion, driving implant and aligner adoption through continued clinical education and account penetration to become the leading partner of choice for corporate dentistry.”

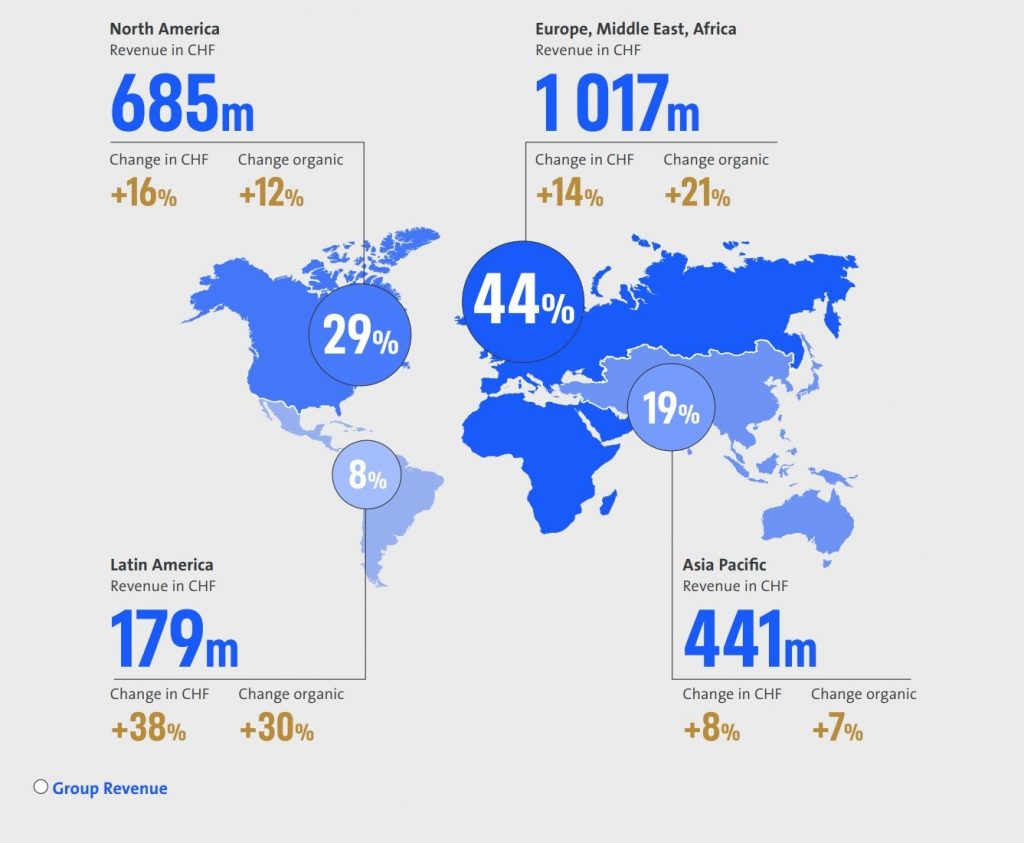

If Straumann’s recent financials are anything to go by, business is booming. The group made CHF 2.3bn (€2.27bn) in FY 2022 which included revenue growth of 14% in Europe and 16% in North America. Group organic growth is up 15.7%.

What is driving that success? Samow says there are two major growth areas / drivers: “Orthodontics is the first. It’s easier for everyone to get treatment now because of clear aligners. You can go to the dental practice, and no one sees the wire and brackets you had back in the day. Clinicians are not afraid to offer this treatment because there is no surgical procedure.

“Clear aligners are being used to treat an increasingly broad range of clinical circumstances, from simple, to moderate, and even complex cases. This means patients’ aesthetic and clinical needs can be addressed with a solution that matches their expectations for a discrete and simple treatment experience.

“The second is the rise of the DSO (Dental Service Organisation). This is the fastest growing segment in dentistry, and it matters to Straumann because it is driving implant and aligner penetration due to the huge investments DSOs make in advertising, which is creating awareness for a lot of patients.

“With implants, it’s all about the DSOs. On the aligner side, however, growth is across the board.”

Founded in 1954, Straumann is the largest manufacturer of dental implants by revenue worldwide, with around 10,000 customer contacts a day. When it comes to growth, however, aligners are seen clearly as the largest untapped market.

According to Samow, across the geographies where it is active Straumann has up to a 50% market share of a CHF 2.7bn (€2.78bn) premium implant market, a 15% share of a 2.7bn CHF value implant dentistry market, but just a 5% market share of a CHF 5.2bn (€5.35bn) clear aligner market: “This is looking at the untapped addressable market, unmet patient needs. The clear aligner market and opportunities there going forward are clearly bigger than implants.”

“Individual dentists find it difficult to access the advanced technologies that can help them explain and position a wider range of treatment options to patients. Innovations such as CBCT scans (a type of CT scan), intraoral scanners and treatment planning and presentation software require a large patient pool and a focused patient generation strategy to realise the ROI for the technology.”

The shift towards increasing use of implants and aligners has seen some operators reorganising and acquiring to take advantage. Take US-based DSO Aspen Dental, one of the largest and fastest growing branded networks of dental offices in the USA, and its 1,030+ practices.

Samow explains: “It supported mainly general dentistry, aligners, dentures, and implants and acquired ClearChoice Dental Implant Centers in 2020, leaders in fixed, full arch dental restorations for patients with missing or failing dentition. Collectively, the two are the largest provider of fixed and removable dental prosthetics in the United States. You enter treatment and emerge with confidence and the ability to enjoy a steak with your family.

HBI 2023 has two dental panels. Rahma Samow is on the first in the morning of June 21, What is your elixir of growth? A dentistry case study, alongside Tom Riall, executive chairman of {my}dentist, Bob Fontana, chairman and CEO of Aspen Group, and Sam Waley-Cohen, founder and group CEO at Portman Healthcare international.

The second panel, in the afternoon of June 21, is entitled Dental models that benefit both customers and clinicians. On the panel are Javier Martin, CEO of Donte Group, Mirko Puccio, founder and CEO of Primo Caredent Group, and Jorg Aumueller, VP enterprise solutions at Straumann Group.